Several insurance companies issue their first Solvency Capital Reporting set to their national regulator according to the new standards, based entirely on Systemic’s technology.

Systemic hosts Director’s Liability event in Luxembourg, gathering together more than 50 Directors and other Funds’ professionals to discuss best practices and assess potential implications arising from insufficient risk management processes.

Systemic addresses the heavy reporting requirements of AIFMD directive with its new reporting service, a combination of technology and services allowing any alternative fund to achieve regulatory compliance with minimum effort and own resources.

Systemic finalizes Solvency II implementation at a major Insurance company, the first to take place within the local market.

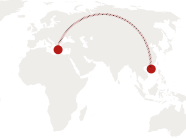

Systemic establishes its Luxembourg office, to address the needs of UCITS and other funds established in the important centre.

Systemic inaugurates its Hong Kong office, in line with its international expansion strategy

Algorithmics, the worlds leading provider of enterprise risk solutions, partners with Systemic to provide risk solutions in the EMEA region.

The issuance of the new UCITS Directive and relevant risk guidelines, provides another major opportunity for Systemic, which is soon chosen by eleven fund management companies to address their risk reporting requirements.

Systemic reaches an important agreement with sixteen cooperative Banks to manage their Basel II implementation needs on an outsourcing basis.

National Bank of Greece, the country's largest and most important financial institution obtains the Central Bank's permission to use the "Internal Models" (VaR based) approach to manage its market risks, based on Systemic's RV Market solution.

Systemic organizes with huge success the first Basel II conference in Athens. The market's very high interest on this subject led to important software development and several Basel II implementations in the following years. Immediately, Systemic starts working on its Credit Risk and Capital Management solutions.

Systemic's market share among the Investment Brokers in Greece exceeds 70%, and becomes the undisputed leader in Derivatives risk management and back office system developers.

Systemic reaches a global agreement with NBG, the largest financial institution in Greece, to evaluate for the first time the Banks and it international subsidiaries exposure to market risks.

The establishment of Athens Derivatives Exchange presents a major opportunity for Systemic. Within a few months, Systemic extended its initial VaR solution to accommodate margin requirements and other risk management tools.

SYSTEMIC RM SA is established in Athens by a team of former financial sector professionals.