Broaden your reach across all investment and risk management activities

with

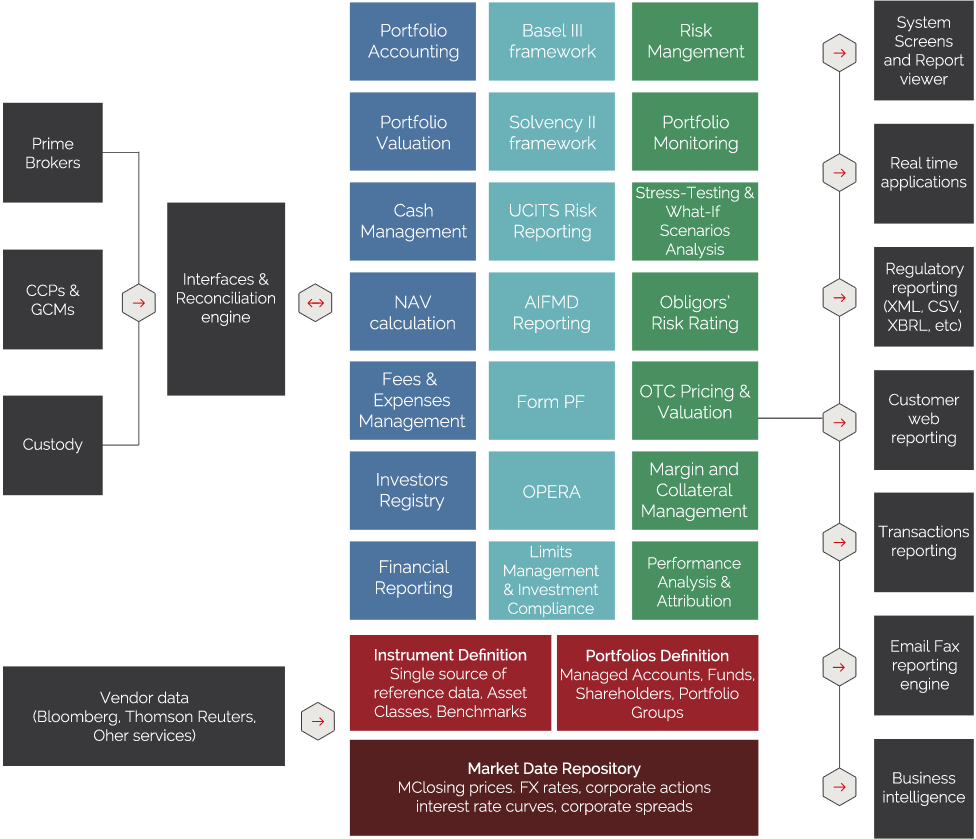

Designed to cover all types of trading portfolios, investment strategies, compliance requirements and geographical mandates, RiskValue® and its embedded risk measurement engine improves your investment management and helps you derive more value from your portfolios. Scalable and fully customizable, it suits both smaller and larger financial organizations.

ONE SYSTEMMULTIPLE SOLUTIONS

You can start with an initial core engine and then you can choose additional modules from a large pool of proven solutions.

Independent, yet seamlessly integrated, modules are offered as an option that can be activated whenever the corresponding operational need arises.

- The benefits of an architecture that is based on multiple building blocks include:

- Easy to use, hassle-free administration

- Central security and audit management

- Powerful reporting mechanism, with data taken from one single database

- Lower costs for licensing additional functionality

- No need for building costly interfaces between different systems

- Backwards compatible future releases

SAME EASY MANAGEMENT

RiskValue® is highly flexible and covers various portfolio types across different financial sectors.

Operations include:

- Managed accounts with assigned investment profiles

- Dealing-room accounts and user-defined hierarchical portfolio structures

- Investment funds and share classes for all investment structures and types

- Customer trading accounts for brokerage operations

- Clearing and position accounts retained to CCPs and GCMs

- Omnibus and segregated accounts that support all prime broker trading models

- Margin accounts with collateralized securities for trading finance

- Shareholder accounts and administration of investments registry

- Model portfolios for monitoring and rebalancing of investment strategies

- Fictitious portfolios for risk- and performance analysis (what-if scenarios)

Web Reporting

- Full-page presentation of categorized reports

- Flexible definition of popular reports

- Central administration with enterprise-level lists and list groups

- Robust access control

Reporting via Email & FAX

- Flexible automatic delivery in Excel, PDF or Word format via print, fax or e-mail (MS Outlook, SMTP)

- Multi-language support

- Preview mechanism for all reports

- Detailed history of past reports

- RV Mail diagnostics

EFFICIENT MANAGEMENT

OF INTERNAL OPERATIONS

- Efficient handling of all post-trade procedures:

- Comprehensive, intuitive and centralized UX (single log-in)

- Discrete calculation procedures for single or grouped portfolios

- Efficient algorithms and calculation processes

- Remote access via standard web browsers (cross-browsing)

- Instant extraction of historical data

- Flexible search of historical information

COMPLIANCE WITH DIFFERENT AUDIT

& SECURITY POLICIES

RiskValue® supports the strictest audit

& security policies of every organisation.

- Central security management and administration

- Standardised, transparent and discrete workflows for all business processes

- Customized warning messages

- Audit reports and error logs for all operational processes

- Four-eyes principle to critical operational procedures (dual-control)

FOR ALL CUSTOMER NEEDS

Highly parameterized and flexible, RiskValue® gives the ability to customize every client need, adding extended functionality, new financial products and specific monitoring tools to the system. Having an in-depth understanding of the financial industry requirements,

Systemic is in the position to deliver the final product at a highly competitive cost and unbeatable time-to-market.

RiskValue® latches on many years of top-level expertise in areas such as:

- Financial risk and investment management

- Financial engineering, pricing models and valuation services

- Investments accounting and back-office operations

- Transactions clearing and settlement operations

- Implementation of BASEL II/III, UCITS III/IV, AIFMD, MiFiD, Solvency II, EMIR and other directives

- Advanced methodologies for investment performance measurement and attribution analysis

- Real-time margin and collateral monitoring

- Investment compliance and limits management

With:

- More than 100 large scale implementation projects in financial institutions, insurance companies, investment and brokerage firms

- 60 customers in 7 countries

- More than 400 users including portfolio and risk managers, traders, back/middle-officers, account and relationship managers

- More than 80 electronic interfaces